Robocash Group analysts revealed that 2050 will mark the age shift in the FinTech audience due to an actively ageing population in Southeast Asia. The most active FinTech audience aged 14 to 65 years will move into the 65+ group, making it the largest increase of 2x in its share.

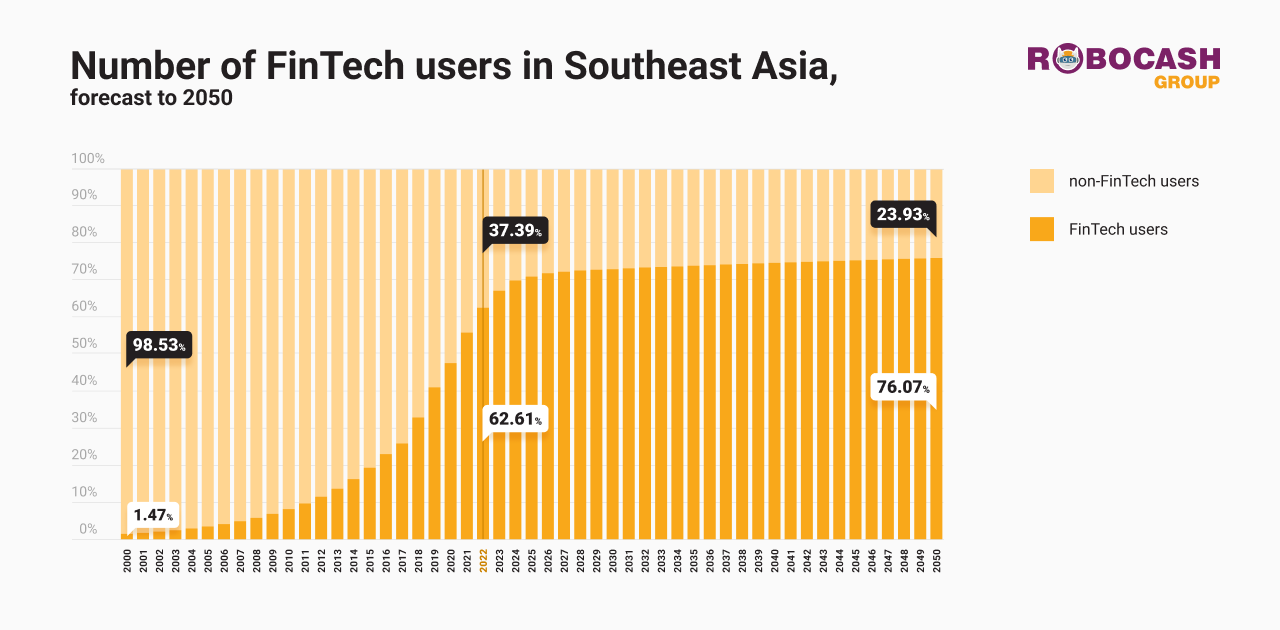

Singapore | December 1, 2022 — As of October 2022, in the SEA region, there were about 426.5 million users of five fintech industries (alternative lending, digital investment, digital assets, digital banking, and digital payments). This is approximately 63% of the total population of Southeast Asia. By 2050, this figure will rise to 76%.

Over the past 33 years, the population of Southeast Asian countries has aged quite considerably. During this period, the number of people aged 65+ increased by 190.2%, the number of young and middle-aged 15-64 – by 76.7%, and children 0-14 by only 3.6%.

It is expected that the total population of the SEA region will grow by 17.9%, from 681 million in 2022 to 803 million in 2050. The largest increase (2x) will occur in the 65+ segment of the audience.

The analysts of Robocash Group said that there is a lack of young people from 0 to 14 years old, whose number promises to grow by only 1.7% over the next 28 years. All this will obviously affect every segment of fintech. Those actively using financial technologies (people aged 15-64) will grow old by 2050 and move into the 65+ group, thereby increasing its share. For the most part, these will be women, who already outnumber men.

“As a result, in terms of the long-term trend, by 2050, the most promising audience for the financial technologies in Southeast Asia is expected to be women over 38 years old, whose share will grow significantly against, bolstered by a life expectancy of 81 years. With an ageing population, fintech industries such as digital payments, banking, insurance, and healthcare could grow significantly”, they added.