Sri Lankan has shown a clear demand for online loans with 9 out of 10 respondents participating in a survey conducted by Robocash expressing the need to borrow extra money and their openness to alternative lending.

The online credit services, along with other fintech products, are to experience swift growth in popularity, claim the analysts of Robocash Group.

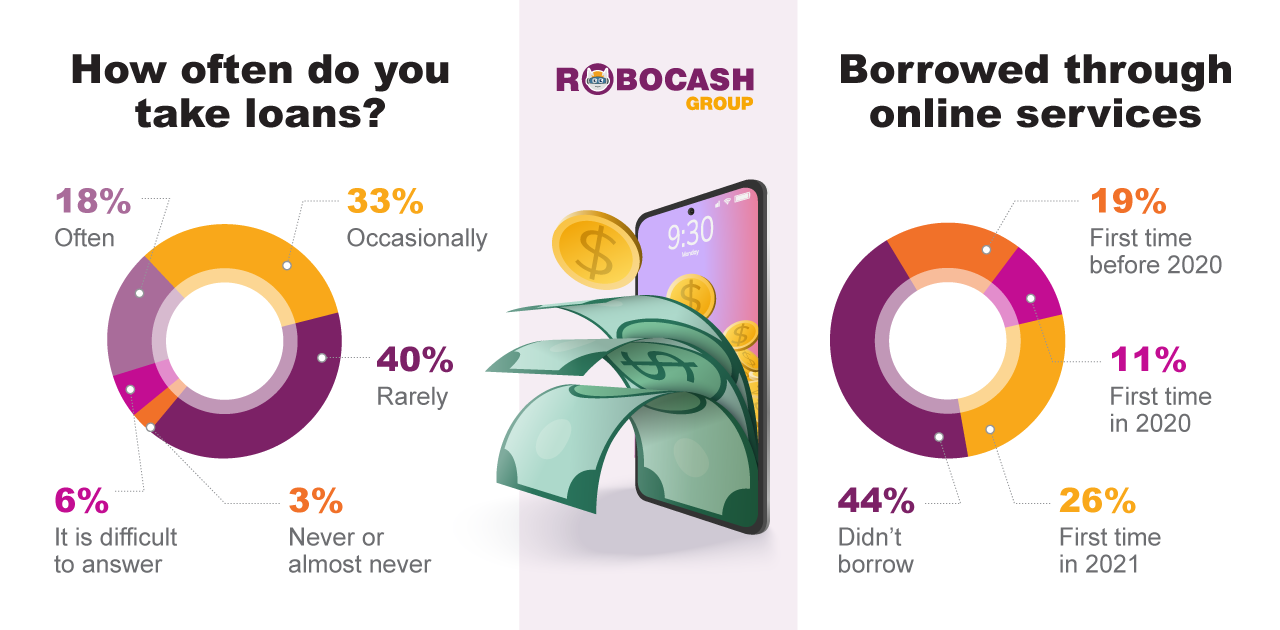

Borrowing funds is a part of life for more than half of the surveyed respondents – the need for a loan comes up frequently (18%) or from time to time (33%). 56% of the respondents attest to having previous experience with online credit services, with a quarter (26%) having used them for the first time last year. The main reason for this is the considerable effect of the Covid-19 pandemic.

More than 37% answered positively when asked about their attitude toward alternative digital lenders. The growth potential of digital loans in the country would lie primarily in a greater degree of information transparency, and improvements in the quality of service and loan terms. These reasons were named as the main factors hindering deeper cooperation with services by 28%, 19%, and 19% of respondents, respectively.

The analysts of Robocash Group comment that the extent of financial inclusion in Sri Lanka is seemingly wide, with 68% of the whole national workforce is employed informally. The growing consumer demand requires more than the banking sector can offer. Thus, in an environment with a generally well-developed technological infrastructure, 50.8% Internet penetration, and 141.7% mobile connections, the digital loans appear to show favorable prospects and swift penetration into Sri Lanka.

Robocash Group is a group of companies, which provides fintech services in Asia and Europe. Founded in 2013, the Group focuses on providing technological finance solutions for the underserved by the traditional banking system. All products of the group are built completely in-house using artificial intelligence, machine learning and data-driven technologies to provide precise and comprehensive risk management, comfort and speed for customers and efficiency for business. For the time of operation, the Group has gained more than 20 million customers and provided financing in the amount of 1.7 billion USD.