Although Contactless payments were introduced in Sri Lanka a while back, the contactless card limits remain rather limited in Sri Lanka when compared to the region and the rest of the world.

Contactless payments are enabled with near-field communication (NFC) technology, and the concept first gained popular usage on Seoul’s transport network in the 1990s. Transport for London introduced the highly successful Oyster card scheme to replace paper tickets on its services in 2023; this in turn inspired Barclaycard to offer Britain’s first contactless bank card for customers in 2007. However, Sri Lanka’s public transport sector is yet to adopt contactless cards despite several attempts to introduce contactless cards in the sector.

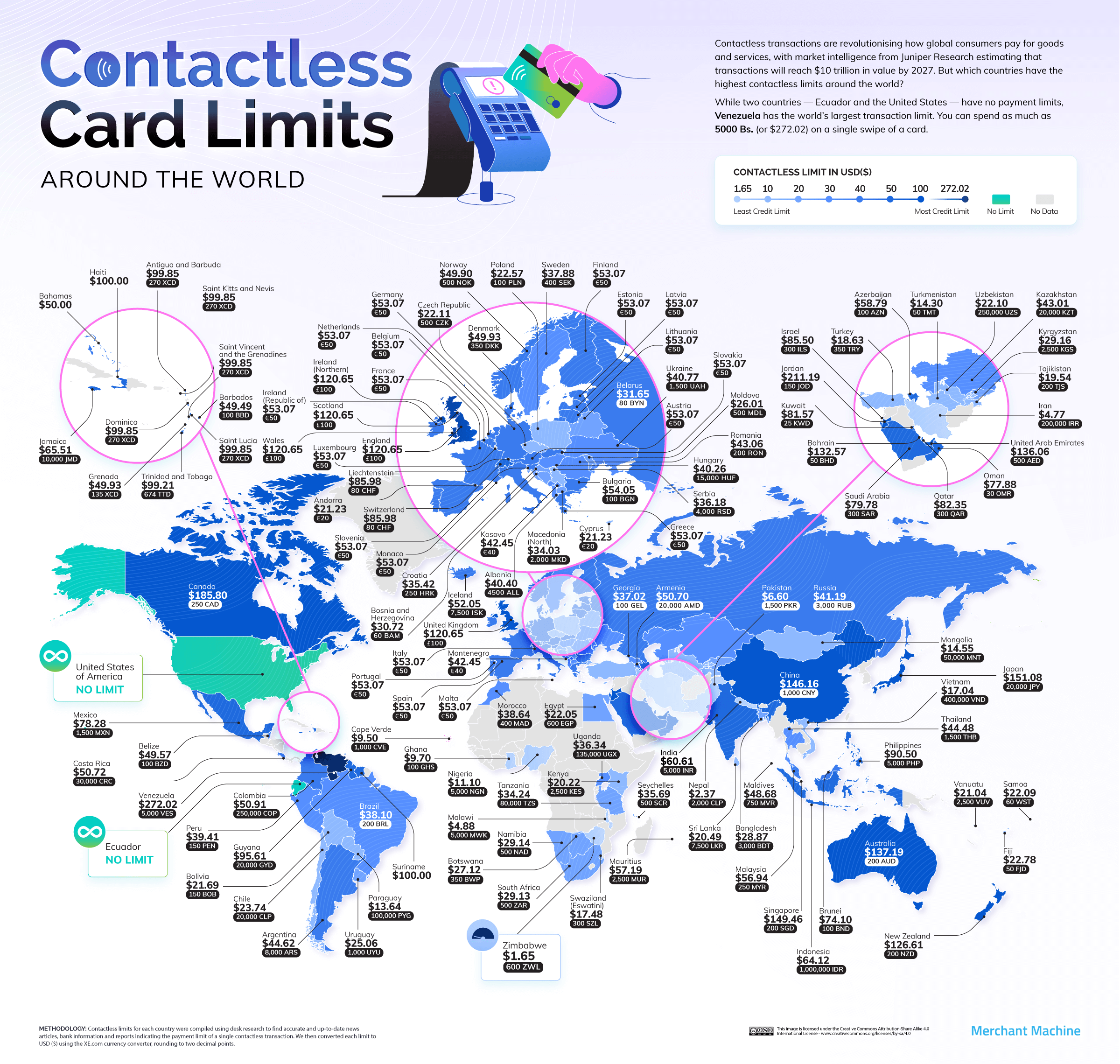

According to Merchant Machine, the limit on contactless cards in Sri Lanka is $20.49, which is below $60.61 limit in India, $48.68. in Maldives and a $28.87 limit in Bangladesh. In much developed countries such as Singapore contactless card limit remains above $100.

Britain Leads the Way in Europe’s Contactless Payment Limits

Despite widespread trust among Scandinavian countries towards their governments and banks, the UK has Europe’s most generous contactless limit – set at £100 ($120.65) per transaction in 2023. According to UK Finance, 9.6 billion card payments were made in 2020 without chip and PIN – up 12% from the previous year. Contactless now accounts for a quarter of all transactions in the country, with smartphone compatibility a major factor in consumer choices.

Within the European Union, payment limits are regulated by the European Banking Authority (EBA), which recommended an increase during the Covid-19 pandemic to €50 ($53) to aid social distancing for merchants. More recently, European lawmakers have launched legal proceedings against Apple for breaching competition law through its NFC technology on its Apple Pay service.

Canada Boasts Highest Contactless Limit in the West

While most countries adopt a transaction limit to protect customers from fraud, the United States is one of two countries where there are no such restrictions. Instead, merchants can place a discretionary cap on payments, meaning that the practical limit is $10,000 for Visa, Mastercard, Discover, American Express, and JCB – the maximum of a standard credit card. However, apps like Google Pay and Apple Pay support up to $50,000 – meaning customers should exercise caution when purchasing.

Aside from the U.S., our research shows that Canada has the highest contactless transaction limits in North America, with consumers permitted to spend as much as C$250 ($185.80 or £154.09) on a single payment. Major merchants Visa and Mastercard worked with the Canadian government to raise the cap from $C100 ($74 or £62) during the Covid-19 pandemic, giving consumers more choice in how they pay for goods and services.

Three Middle Eastern Nations Have Contactless Limit Above £100

The research shows that the region has three of the ten highest contactless transaction limits anywhere in the world, giving shoppers more freedom over their purchases. Jordan (JD 150, $211.19 or £175.14) leads the way, boosted by the country’s emerging fintech hub. In late 2021, Mastercard became the first merchant to launch a biometric card, rolling out the technology in collaboration with Jordan Kuwait Bank.